A fixed asset inventory is a detailed record of all tangible assets (with their general and/or specific characteristics) owned by an enterprise, such as machinery, equipment, vehicles, buildings, etc. These assets are not expected to be sold in the near term, and they play a vital role in the production and delivery of goods and services. Maintaining accurate inventory is critical to assessing a company’s value, managing assets effectively, and complying with accounting and tax regulations.

The quality of the inventory is much higher if it is carried out according to the standard of “indivisible smallest unit”, which is understood as “a mechanical unit consisting of the equipment itself, driven by a certain device or transmission, and, where appropriate, followed by small equipment or facilities and their works directly related to the equipment, such as civil engineering facilities, machinery, electrical, pumps, valves, pipes, instruments, etc.”.

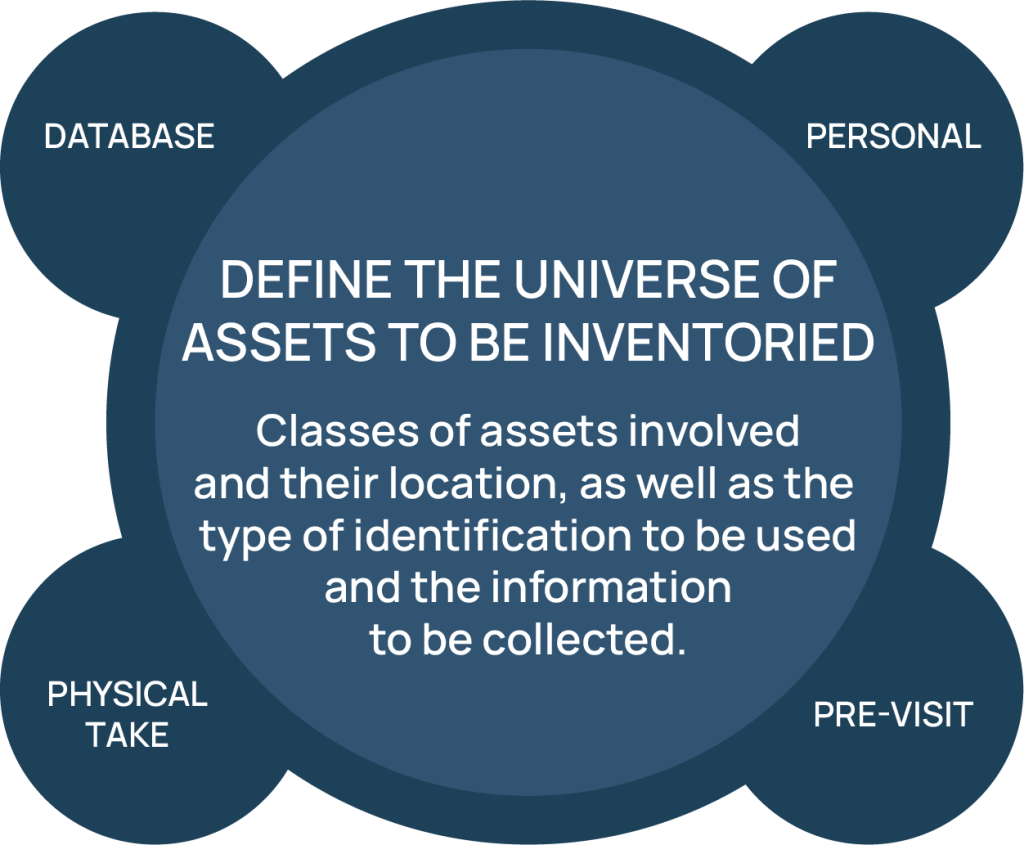

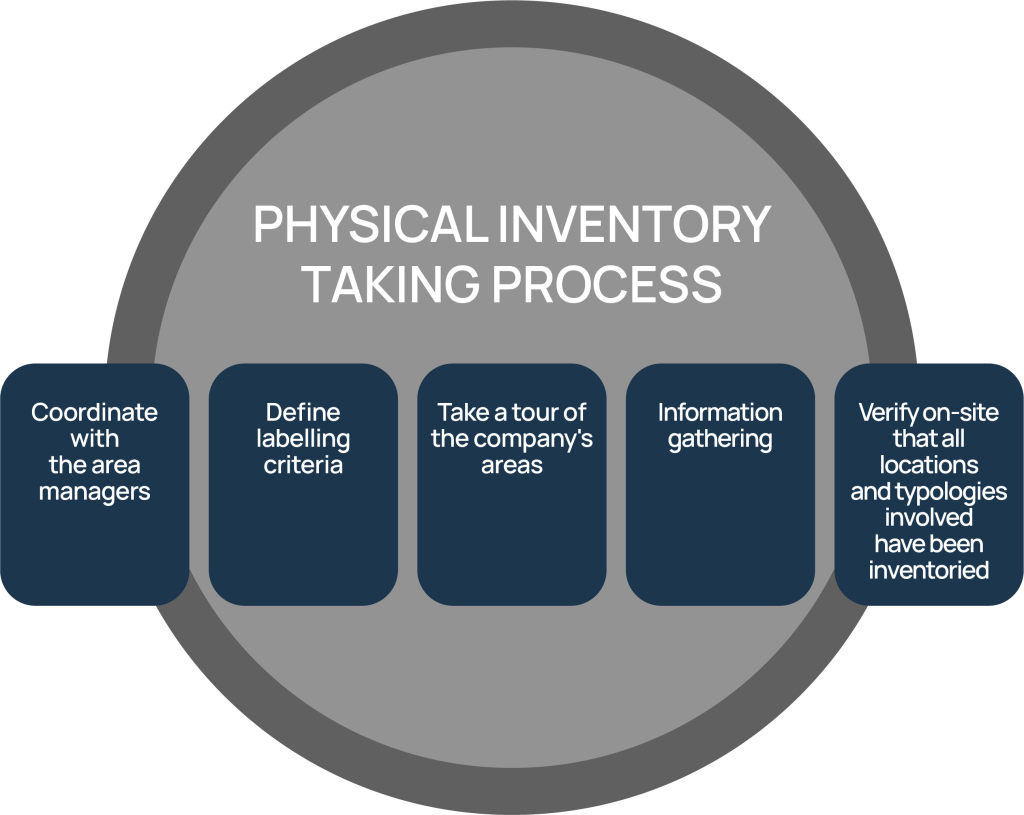

The following pictures introduce the main aspects and general activities to be considered in the process of fixed asset inventory:

The Fixed Asset Inventory is essential for the financial and accounting management of any organization. Its importance is listed below:

Fixed assets represent a significant part of a company’s total value. With an accurate inventory, you can correctly assess the weight of their value within the organization.

Inventory allows you to manage and maintain assets efficiently. This includes scheduling maintenance, knowing the right time to acquire new assets, and eliminating obsolete ones.

Accurate record keeping is crucial to comply with tax and accounting requirements

It is also very useful in situations of merger, division, contracting insurance that covers all assets, avoiding paying an undervalued (Underinsurance) or overvalued (Overinsurance) premium.

The database obtained from the Fixed Assets inventory (Physical Base) must be related to the Accounting Assistant. The objective is to assign and corroborate the book values of each physically identified asset, which will result in:

With more than 20 years of experience in taking fixed asset inventories in all types of industry, we offer the best technological solutions to guarantee reliability and efficiency in all our field work, which is why we offer you the following options: